RECENT POSTS

-

Motor Fleet Insurance in Dubai, UAE [2023 Ultimate Guide]

25 April, 2023

-

Directors And Officers Insurance Dubai [2023 Guide]

27 December, 2022

-

Maternity Insurance Dubai: 2022 Ultimate Guide

5 August, 2022

-

Property All Risks Insurance Dubai, UAE

30 March, 2022

-

CFI.co awards Best Corporate Health Insurance Brokerage – UAE 2021

28 March, 2022

Motor Fleet Insurance in Dubai, UAE [2023 Ultimate Guide]

Motor fleet insurance is a comprehensive insurance policy designed for businesses that operate multiple vehicles under a single umbrella. This type of insurance aims to provide coverage for all vehicles in a fleet, safeguarding the business from financial risks associated with accidents, theft, and damages. Fleet insurance policies offer flexibility by allowing businesses to customize […]

Directors And Officers Insurance Dubai [2023 Guide]

If you are a growing business in Dubai, you need Directors and Officers Insurance. Directors and Officers Insurance offers a much-needed layer of protection for all types of companies across all industries. Simply contact Lifecare International for a free quote today. Our Directors and Officers Insurance Dubai Guide will help clarify everything. To begin, let’s […]

Maternity Insurance Dubai: 2022 Ultimate Guide

In 2013, the UAE government made health insurance coverage mandatory and accessible for all residents and their dependents through the Dubai Health Insurance’s Law No. (11). This law meant that employers across the nation would be legally obligated to provide health insurance with maternity benefits to their employees. It would also need to be extended […]

Property All Risks Insurance Dubai, UAE

What Is Property All Risks Insurance? Property all risk insurance Dubai, also known as business property insurance, covers risks of physical loss, destruction, or damage to the insured property during the policy’s active course. The insurance policy is subject to specific terms, conditions, and exclusions. The insurance plan’s overall objective is to protect business owners […]

What Is Critical Illness Insurance in Dubai, UAE

Critical illness insurance provides the policyholder with medical coverage for a long-term critical illness that requires specialised and expensive medical treatment. If the policyholder is diagnosed with a predetermined critical disease, they will receive a large lump sum payment following a standard multi-day grace period. Insurance companies will offer two options to purchase critical illness […]

Is Health Insurance Mandatory In Kenya

Health insurance is one of the best assets one can invest in. Healthcare costs across the globe are steadily rising; therefore, the financial impact of an unexpected illness can be devastating to many households without insurance. Making it worse is that, in many cases, people are left choosing between paying for a medical bill or […]

Workmen’s compensation insurance – what is it and why do you need it?

Keeping employees safe at work is a top priority for any business. However, it is not always possible and sometimes accidents occur. But while it is not always easy to protect your staff against accident and injury, it is possible to ensure that they are covered against loss of earnings and expensive medical bills should […]

Mandatory Health Insurance Qatar

A recent law in Qatar stipulates health insurance as a mandate for all expatriates and visitors. With this new development in healthcare law, you can find yourself trapped in a spiral of healthcare insurances and the different converge they offer. While there are many health insurances for you to claim from, one that is tailored […]

Key man insurance UAE: 2022 Guide

Is your business insured? Like your cars and home, key man insurance UAE is critical in order to ensure the sustainability of your business, irrespective of who comes or goes. Undoubtedly, businesses are set up to make profit. This is why marketers are always on top of their game, looking for ways to boost business […]

Private Health Insurance Broker UAE: Benefits of using a broker

Just as a tour guide makes it easy to navigate a new environment, private health insurance brokers simplify the entire process of purchasing the best health insurance policy. Insurance brokers are experts whose primary duty is to help you get the best insurance option on the market. Simply put, they act as an intermediary between […]

Love the skin you’re in!

With May being Skin Cancer Awareness Month, Lifecare looks at the need-to-know info on sun safety, and how to avoid and spot skin damage and abnormalities The prognosis for skin cancer is incredibly reassuring, with the Skin Cancer Foundation confirming the five-year survival rate of melanoma (the most serious form of skin cancer) to be […]

How to beat virtual meeting fatigue

It was the perfect solution to the pandemic, but now video conferencing is leaving us exhausted. Lifecare shares our top tips to lessen the draining effects of virtual communication Video conferencing is now the norm in both our work and social lives, but if you’re finding yourself avoiding, dreading or exhausted by online meetings – […]

Personal Medical Insurance in Qatar – Everything You Need to Know

People tend to go through life without a proper plan for accidents. Granted, no one expects to wake up someday bedridden and unable to go about their work as usual. But let us face it, accidents happen. Illness arises at some point in life. And this is a hard but inevitable truth. Having a good […]

How to have a healthy, hearty Iftar and Suhoor

Lifecare looks at the most nutrition-rich, slow-release energy foods that will assist your fast this Ramadan. Dr Rahma Ali, a clinical dietician at Burjeel Hospital Abu Dhabi, explains that “fasting during Ramadan can improve one’s health, but only if done properly. If not, it can cause more harm than good.” The foods we choose to […]

Are your employee benefits in the right era?

Latest trends tell us the world’s wider workforce has completely transformed its core values as we continue to live alongside the pandemic. Lifecare looks at what’s most important to your team in 2021, and how you could – and should – adjust your employee benefits offering. If your company has been extending employees largely the same […]

Expat Health Insurance Qatar: 2021 Guide

Your health insurance is one of the most important investments you will make. As such, you need the help of a professional to guide you in choosing the best expat health insurance Qatar for you and your family. At Lifecare International, our experts are committed to helping you navigate this overwhelming journey to ensure you […]

The changing landscape of insurance in the Middle East

Author: Alniz Popat (Founder and CEO of Lifecare International) Article published in: Middle East Insurance Review (Jan edition) Over the last decade, the medical insurance industry in the GCC has become saturated with too many insurers in the market. There are over 35 insurers in the market, each with different long-term and short-term ambitions. This fragmented […]

Medical insurance for dependants in Dubai

In 2016, Dubai officially joined Abu Dhabi in the compulsory health insurance policy. If you currently live in Dubai or are planning to move down here, we strongly advise you to get familiar with the medical insurance rules to avoid the common mistakes expats make. Even better, be sure to contact a professional insurance broker […]

World Cancer Day 2021: Celebrating how far we’ve come

Lifecare takes a look at the highlights of critical cancer research and medical developments, as we mark the international day of awareness of the disease that is so close to so many. It is easy to be scared by some of the statistics linked to cancer, but there is also so much to celebrate when […]

Managing back to school anxiety for your child and yourself

Following one of the world’s most prolonged periods of pandemic-led school closures, Kenya’s families are now making the transition back into face-to-face learning for our children. With more than nine months away from the education system, peers and classrooms they once knew – new procedures, fears and a lingering sense of uncertainty – it is […]

Why we now truly believe age is just a number

Sixty isn’t the new 50 – it’s even better than that! Lifecare looks at the many reasons there is so much to look forward to in later life, if we look after ourselves Are you young, old, or ‘young-old’? If you can’t put yourself in a category, it’s because you don’t need to! Society once […]

How and why we need to replace human touch

The pandemic has left us actively avoiding contact, starving our bodies of a basic human need. Lifecare looks at ways to fill the void social distancing has left behind The increasing digital age had already replaced physical interaction on so many levels before COVID-19 descended on the world. Scrolling for groceries and gifts and celebrating […]

The seven dimensions of wellness

What does ‘wellness’ mean to you? Lifecare breaks down the wider list of facets we must consider to achieve a true sense of wellbeing If modern day marketing is to be believed, following a single diet, exercise programme, app or mentor can lead us to a life of ‘wellness’. A buzzword now overused to the […]

Best Health Insurance for Families in Dubai, UAE

Are you wondering how to choose the best health insurance for your family in Dubai? Come in, let us help you! If you are living in any of the emirates in the United Arab Emirates (UAE) or planning to move to any of the emirates, I will go out on a limb and say you […]

Why women’s health needs to be in your mind for longer than a month

October may be the month Breast Cancer Awareness campaigns capture the most column inches, but Lifecare pioneers women’s health and protection all year long Most of us will have been ‘thinking pink’ last month, as the global drive for Breast Cancer Awareness made women, men and children alike learn the facts, recognise the signs, and […]

Cybercrime Insurance Dubai UAE

Is your business truly safe? Welcome to the computer age where businesses are run online. As a matter of fact, you need to integrate some level of IT if you want to keep a competitive edge over your competitors. While technology is a lucrative enhancement for businesses, it also comes with a drawback – cybercrime. […]

The mental cost of 2020, and how to counteract It

Lifecare explores the impact on mental health caused by this year’s global pandemic and economic crisis, and how we can restore the balance. Surges in stress, anxiety, depression, addictive behaviour, self-harm and substance abuse are among a long list of effects the COVID-19 pandemic has had on the global population. Trusted public health authorities including […]

Time Difference presents Challenges with Online learning: How to sleep on Demand

International students are joining online lessons at all times of day and night. But how can they make sure they get enough sleep to stay focused? Sleep deprivation has become an increasing global problem among the millions of students who are attempting to keep up with their online studies from the differing time zones of […]

Redundant? Plan Your Next Financial Move

Lifecare’s expert financial planners take you through the quick fixes and pitfalls to consider if you’ve suddenly lost your job Hundreds of millions of jobs have been terminated across the globe as a direct result of COVID-19, so you are certainly not alone if yours was one of them. If you hadn’t made ample provisions […]

On Father’s Day, All They Want Is A Healthy You

As soon as you become a father, your health goes from a personal choice to a pivotal responsibility. Read Lifecare’s recap on increased health risks for 40+ males, and how to keep them in check. The best gift you can give your children – is you. The fun-filled, vibrant, energetic version of you, who can […]

Another Day Without Life Insurance? You’re Rolling The Dice

If you’re still not covered… Lifecare explains why life insurance and critical illness cover needs to be moved to the number one spot in your 2020 budget. We need to learn our lessons from COVID-19. Living for tomorrow has always been a gamble, but the pandemic has made us realise just how much we roll […]

Premium Health Insurance Dubai, UAE

Do you really need a premium health insurance plan? Of course, nobody enjoys being ill. However, falling sick is an inevitable part of life. Knowing that falling ill is almost inevitable, the key move should be how to protect yourself. Unfortunately, some people still feel premium health insurance Dubai isn’t necessary. When, in fact, it […]

Staying Healthy during Ramadan

We hope that everyone is keeping safe and well! Here at Lifecare, we’re all about sharing knowledge with everyone on how best to stay healthy. Ramadan is well underway, and one of the most important areas to focus on, is staying committed to healthy eating habits. Here’s a few reminders to help you stay on […]

Why now is not the time to downgrade your health insurance policy

If COVID-19 persists, and forces insurers to restrict coverage, Lifecare International Insurance Broker explains why you’ll want a policy with strong core values in your corner In times of financial strain, we look to cut costs. If your health insurance policy is due for renewal in the coming months, you might be drawn to cheaper, […]

Why You Should Review Before You Renew Your Medical Insurance

Why You Should Review Before You Renew Your Medical Insurance To ensure that you are paying the most competitive premium To ensure that the level of cover meets your current needs and requirements To understand the utilization of your policy and establish which benefits are key and what can be removed To ensure that you […]

Coronavirus: How to manage your mental health during self-isolation

A long period of isolation during COVID-19 may well be a necessary measure for public health, but it has been acknowledged that it could also have a detrimental impact on people’s mental health. Here are some tips which you could practise if your mental health is getting affected during self-isolation. One of the main problems […]

What is malpractice insurance?

Often purchased by healthcare providers, malpractice insurance is a form of professional liability insurance. Malpractice insurance protects those who dispense health advice, treatments or diagnoses against claims of negligence made by patients. Essentially, should a patient claim they were harmed due to negligence on the part of a healthcare provider, this type of cover can protect against the financial impact of any legal proceedings.

5 Incredible Benefits of Using a Medical Insurance Broker

How do you get your insurance? From a broker? An agent? Or the insurance company? Nowadays, choosing an insurance policy is as easy as can be. You are provided with three cool options – go directly to the company, meet an agent, or work with an insurance broker. More often than not, people opt for […]

Medical Insurance Dubai – what cover do I need?

If you’re looking for a medical insurance in Dubai or the UAE, please contact us. Since the final rollout of mandatory health insurance in 2016, it has been a legal requirement for everyone living in the UAE to have adequate medical insurance – employers must cover their employees and individuals must cover any dependants and […]

Is it really worth the risk of not investing in life and critical illness insurance?

Have you always avoided thinking about life and critical illness insurance? If so, you’re not alone. But by not taking the time to put the right protection in place, you could be putting your own future and your loved ones at risk. It’s true it’s not the sunniest of topics, but studies have shown that only a fraction of people living in the UAE have life and critical illness cover, so it’s an important one. If you have a family or dependents that rely on you, it’s important to take the time to consider your options to make sure they will be protected financially if something happens to you.

Better Together Mara Medical Camp 2019

Three years ago, Lifecare International began an inspiring project to express our dedication not only to providing insurance, but to enhance the wellbeing of others around the world. May 2019 saw our third annual Better Together Mara Medical Camp take place. Co-sponsored by Lifecare International and Bupa Global, the event provided much-needed medical treatment to […]

Cost cutting? Why reducing employee healthcare isn’t saving you money

If the spiralling cost of employee health insurance in Qatar is forcing you to consider cutting back on the quality of the healthcare package you offer, think again. Here we look at how cutting your healthcare spend affects the cost-effectiveness of your workforce.

4 reasons why it’s time to consider supplementary health insurance

Does your employer cover supplementary health needs? If so, breathe a sigh of relief but don’t get complacent. While dental, vision, critical illness and long-term care are the first four on the ‘supplementary’ list, they aren’t the only additional health scenarios you need to consider. Are you thinking about having a baby, do you travel internationally, or would you like the peace of mind that comes with having comprehensive coverage for your children, spouse or elderly parents? If so, it’s time to consider supplementary health insurance.

If you want to make savings, it’s time to let LifeNet manage your employee healthcare

‘A future of healthcare that is increasingly preventative, personalised and precise’. That was the picture that emerged when The Economist Intelligence Unit carried out a survey in Asia, the Middle East and Africa with a view to determining the future of healthcare. Can we expect this and other key trends to have a dramatic impact here in the UAE? And what will this mean for your company and your employees?

4 UAE healthcare trends that will affect you in 2019

‘A future of healthcare that is increasingly preventative, personalised and precise’. That was the picture that emerged when The Economist Intelligence Unit carried out a survey in Asia, the Middle East and Africa with a view to determining the future of healthcare. Can we expect this and other key trends to have a dramatic impact here in the UAE? And what will this mean for your company and your employees?

This is what worries your employees – and here’s what you can do to help

Employees who rate their company as ‘caring’ are far more likely to be engaged. The biggest enemies to employee engagement are worries over stress, health and money. For the sake of your employees, and for your business, it’s important to address these worries and take action to allay them. Here we look at these worries and how you can combat them for good.

The 6 best ways to lower your company’s health insurance premiums

Cutting costs. It’s a priority for most employers, and understandably so. However, there’s an art to lowering company health insurance premiums while still providing a valuable and meaningful package for employees. So how often do you encourage your staff to be proactive about their health? How influential are you in their overall approach to wellness? If the answer to both of those questions is ‘not very’, it’s time to make a change.

Top Middle East healthcare concerns – and how to limit their impact on your employees

In recent years there has been a pronounced shift from communicable to non-communicable diseases in terms of the biggest health problems facing the Middle East. Here we take a look at practical steps you can take to reduce the impact of some of the region’s most pressing health concerns on your workforce and your business.

Workplace hazards: 5 ways your office set-up could be harming your employees

From eating lunch at your desk to dirty air conditioning (AC) systems, most offices are rife with threats to health. Often, it’s the very aspects of office life that are designed to increase convenience and productivity, such as open-plan layouts and vending machines, that end up damaging employee health and well-being. Ultimately this reduces productivity levels. Here we outline how you can make sure your office is as healthy as can be.

Five customer experience mistakes and how you can avoid them

Customer expectations are higher today than ever before. Yet while 80% of senior executives in numerous sectors think their company provides a superior customer experience, only 8% of their customers agree. In this article we will help you to better understand how you can avoid the most common detrimental customer experiences with minimal time and expense.

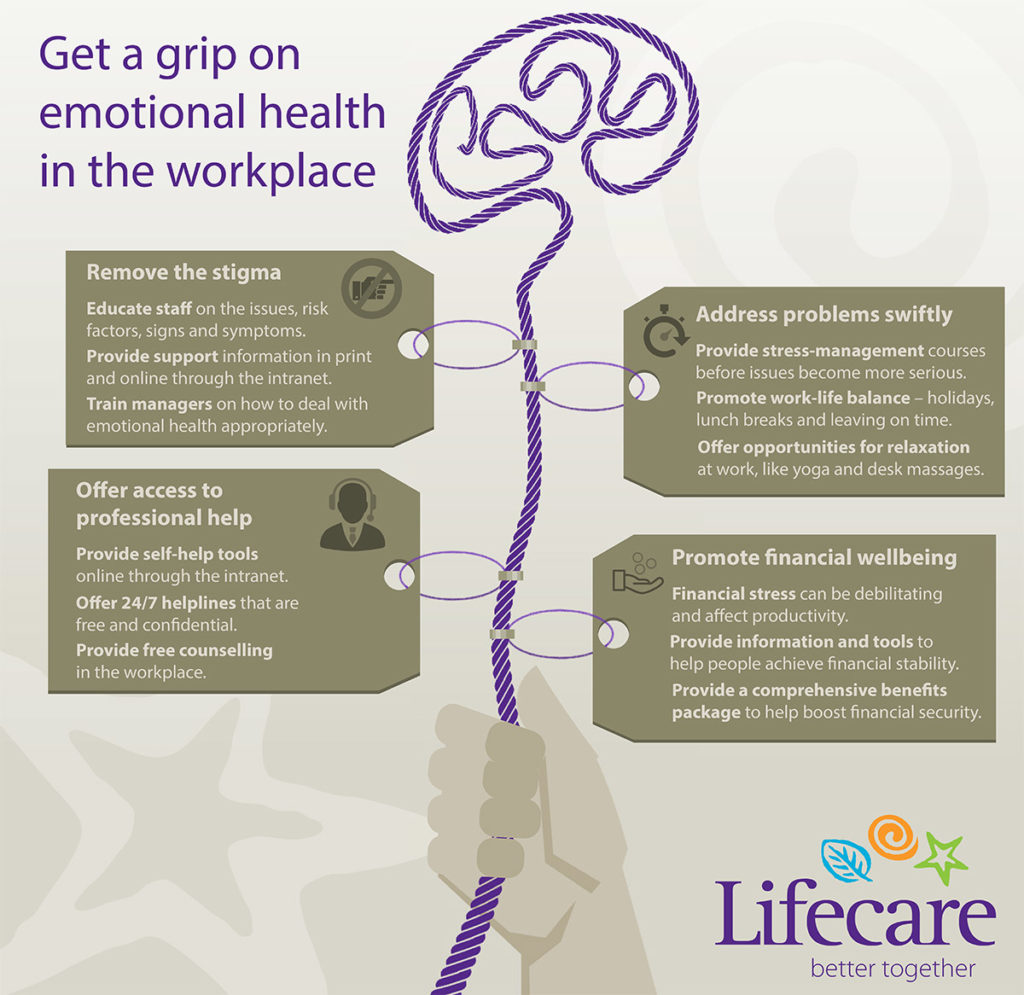

Get a grip on emotional health in the workplace (INFOGRAPHIC)

In our latest infographic we look at how you can get a grip on emotional health amongst your employees in the workplace.

The rise of insurtech in Kenya: What does it mean for your company?

If you haven’t heard of insurtech yet, it’s time to get with the programme. This new buzz-word is short for insurance technology and it’s going to be a game changer. The term echoes the more familiar ‘fintech’, an umbrella term for the wave of technological advances that have transformed the banking and financial services sector in recent years. Now, analysts predict a similar technology-driven transformation in the insurance industry – hence insurtech. In this article we’ll take a look at the insurtech trends that are shaping up, what’s already happening here in Kenya and how your company and your staff could stand to benefit.

Five easy ways to protect your company against cyber attacks

As recent data breaches indicate, businesses of all types, sizes and in all locations are at real risk of a cyber attack at any given moment. Latest figures have shown that cyber crime affected 3.72 million people in the UAE in 2017 – costing the country almost AED 4bn. In reality, there are just five specific steps that all companies need to follow to effectively protect against cyber attacks: secure your hardware, encrypt and backup all your data, encourage a security-centred culture, use robust firewall and anti-malware software, and invest in cyber security insurance. Here’s how to put these steps into action.

How can tech cut your healthcare costs? (INFOGRAPHIC)

In our latest infographic we look at how technology can help cut your company’s healthcare costs.

Excellence delivered: How can your company unlock great customer service?

Creating a great customer experience is worth the investment. From individual touch-points through to transformational initiatives that involve your entire organisation, the simple fact is that most businesses need to improve their customer experience to clearly stand out from the crowd. Here we lay out five key points on how – and why – to improve your customer experience.

Gratuity pay outs: How to protect your business from a nasty surprise

Failing to prepare for gratuity payouts could be disastrous for a company in the UAE. Yet many business managers in the Emirates don’t fully understand gratuity, let alone have a plan in place to save money for future payouts. To avoid any pitfalls and protect your business, it’s important to understand how much gratuity costs, how to save for future payouts, and the alternative options available.

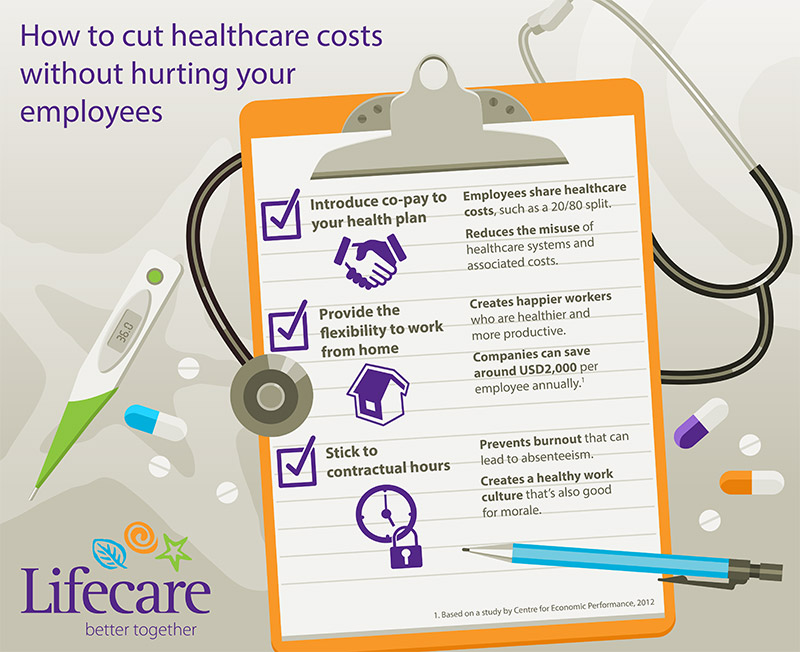

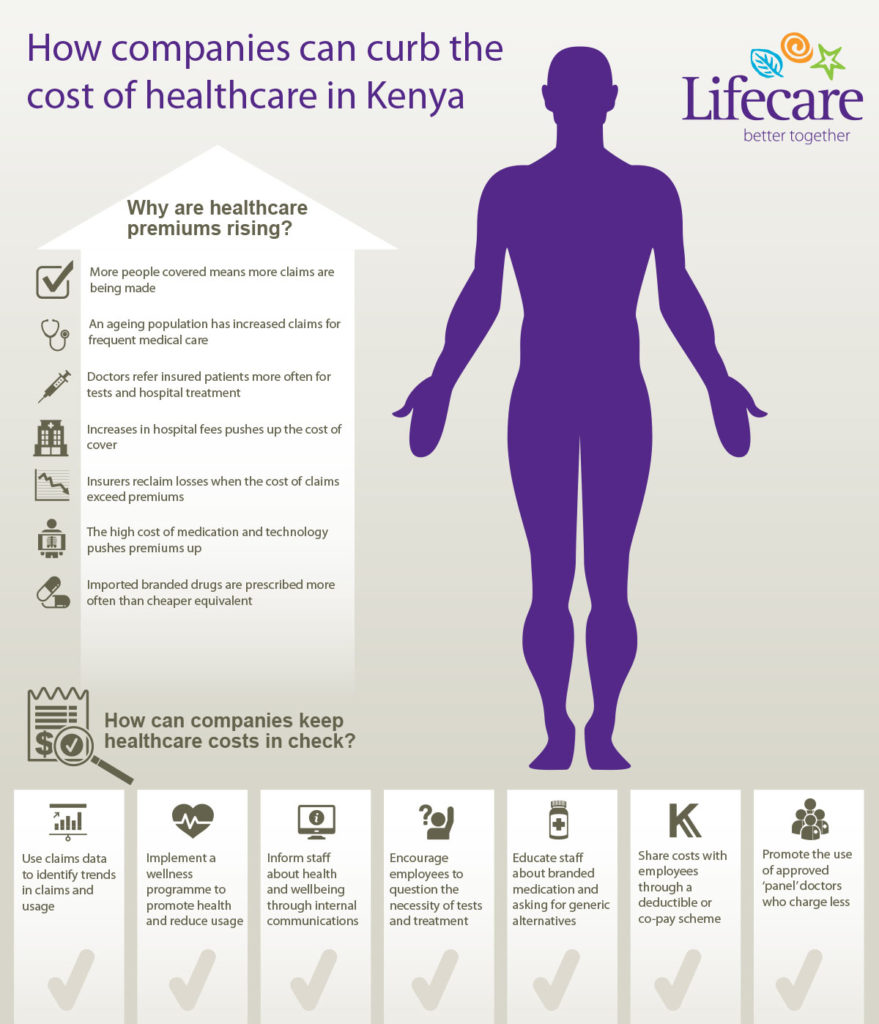

How to cut healthcare costs without hurting your employees {INFOGRAPHIC}

Click image to view in full.

Healthcare inflation in Kenya and what it means for your company

While the general rate of inflation in Kenya has dropped rapidly over the past year, healthcare inflation – a measure of the cost of medical insurance premiums – has remained high. So in real terms your health company’s insurance premiums are likely to be going up. What does this mean for your business? And what tools are at your disposal to address the problem at hand?

Stress, depression, anxiety: Is your company doing enough to support emotional wellbeing at work?

From blood pressure testing to gym membership and stop-smoking programmes, you probably offer plenty of ways to help your staff stay physically fit and well. But what about their emotional health? Once a taboo subject, emotional wellbeing is becoming an increasingly important issue for companies, and for good reason.

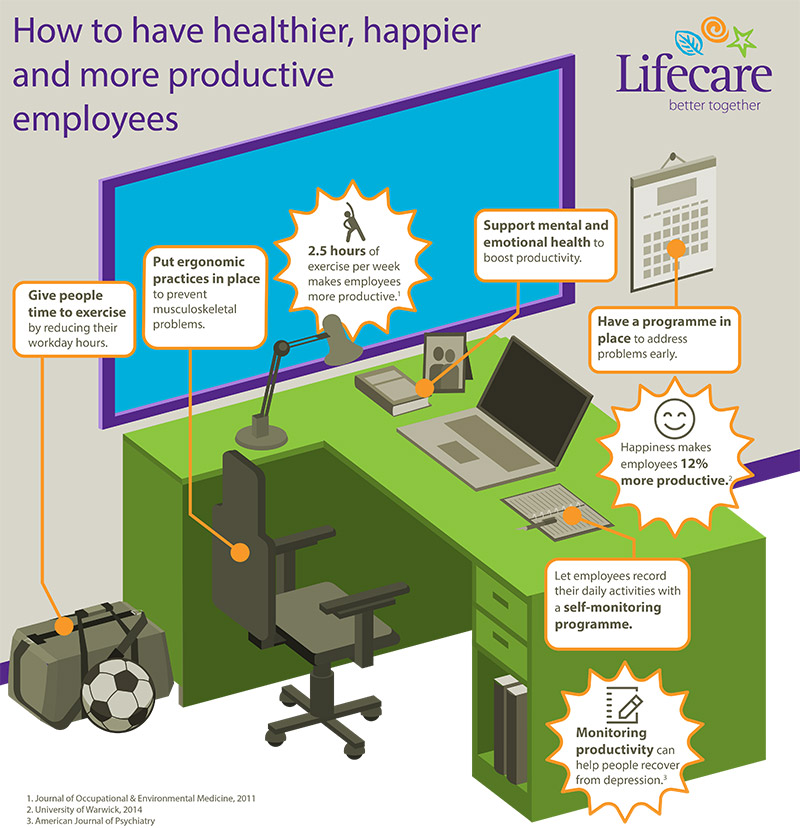

Happiness and productivity: Why a happy workforce will benefit your company

Happiness in the workplace is important: a content and motivated team equals a healthier, more engaged and productive workforce. In 2015, research at the UK’s University of Warwick found that happy employees were 12% more productive than others – the explanation being that happiness leads to more engagement and effective use of time.

Smart savings – getting the best returns on investment in the UAE

Living in the UAE can be highly profitable, with professionals from around the world attracted by the unique lifestyle of tax-free salaries that can help maximise income and build a strong future. But creating an optimal investment plan is about more than just putting money in a few containers. It’s about laying the foundations for a protected lifestyle and understanding exactly how time will shape your activities. Most importantly, to achieve the best returns on your savings, you need to look at the whole picture rather than just individual parts.

Don’t renew without a review!

Creating the right healthcare package for your employees is crucial when it comes to attracting and retaining top talent. A 2015 survey by a recruitment website found that 40% of employees valued healthcare benefits over a pay increase – which is why tuning into your staff’s needs is essential in order to offer the best package. However, what may have been the best health benefits package for your workforce one year may not necessarily be the most relevant for the next. So, while automatically renewing can be quick and hassle-free, when it comes to updating your annual healthcare plan, is it really your best option?

How digital technology could help to cut your company’s health costs

In recent years, technical innovations have been bringing about some really positive changes in Kenya’s healthcare sector. While many of these developments are primarily aimed at improving access to healthcare for the urban poor and people living in remote rural areas, some have real potential to reduce the health insurance premiums that companies pay to protect their employees. Here we’ll take a look at some of the inspirational technology that is already changing lives in Kenya, the trends shaping the direction of this exciting field, and ways your company could benefit.

Medical tourism in the UAE: Assessing the impact on your company

The UAE’s medical tourism industry has grown remarkably in recent years, bringing significant income to the region while boosting its global standing. It’s undeniable that this spells good news for the national economy, but what does it mean for individual companies and residents? The answer lies in understanding the current medical tourism industry and how the public and private sectors are most likely to respond to it.

Stuck in the dark? Five signs your financial advisor isn’t working for you

Financial advisors in the UAE have a mixed reputation, and with good reason. Unauthorised and unqualified advisors are rife, and many clients have been hit with painfully high upfront management fees; or found themselves locked into unsuitable agreements with expensive exit penalties. Against this background, it’s not surprising that people using financial advisors in our region are becoming increasingly careful when it comes to choosing between them. But how can you be sure you’ve hired a trustworthy, suitable advisor? More importantly, how can you spot the signs that your advisor really isn’t working for you?

Will your company be a victim of cyber crime in 2018? Here’s how to protect your business

Cyber crime is not a new phenomenon. But with more and more companies storing data, both on the premises and in the cloud, and the number of internet-connected devices rapidly increasing, the opportunities for cyber attack continue to escalate. UK based digital market specialist Juniper Research has predicted that, due to the rapid digitisation of both enterprise records and consumers’ lives in general, the cost of data breaches will reach a staggering USD 2.1 trillion globally by 2019, increasing to almost four times the estimated cost of cyber crime in 2015. It’s imperative, therefore, that businesses, particularly in the Middle East, become aware of the threats facing them from cyber saboteurs and take appropriate action to protect themselves.

Kenya’s top five health concerns – and how you can protect your workforce

Helping to protect your staff from the country’s biggest health threats makes good business sense. Not only will it give you a healthier, more productive workforce, it will also help keep your health insurance costs low, attract high-calibre staff and foster loyalty among employees. In this article we take a look at the five top health challenges affecting Kenyans today – and what your company can do to help look after its workforce.

Big moves at the NHIF – can Kenya’s revised state health insurance system ease the pain for businesses?

The Kenyan government recently announced that there are now 6.5 million principal members registered with the state-run National Hospital Insurance Fund (NHIF), 55% of whom are in formal employment. Given that each principal member is entitled to extend the cover to their dependants, the total number of people covered could now be more than 25 million – around half the population. From a business point of view, a strong state-funded healthcare insurance system can be a significant benefit, helping to reduce the burden on private healthcare schemes and thus enable employers to provide their employees with a their own health cover that is of genuine benefit. So is Kenya’s reinvigorated NHIF a robust system and, if so, how can businesses make the most of it?

Are your financial advisor’s fees eroding your savings?

Expert financial advice boosts your savings and reduces your outgoings – it’s a weighty investment well made. How then do we validate our choice of expert? Which choice is the “right” one? A telling distinction is how your advisor is compensated for their work. Some advisors earn commission for selling you certain investment products, whilst others are paid a simple fee for their services. The difference between fee-based and commission-based advisors isn’t just technical – the way in which they’re compensated can have a huge impact on their motivations, advice and decisions regarding your money. Let’s look at the difference between the two.

Business interruption insurance explained

Modern business is full of risk. There’s no escaping it. But it is possible to mitigate against. You cover your assets and your people against such risks, but what about your income? Business interruption insurance lets you do just that. Essentially, business interruption insurance – also known as business continuity insurance – is a type […]

Lifecare – the leading insurance brokers in Dubai

There remains much confusion over the difference between insurance brokers and insurers. Where insurers offer policies directly, insurance brokers work with hundreds of insurers to get the best price and the best cover for their clients. Essentially, the role of an insurance broker is to understand your needs and find the policy that best fits. […]

What is marine insurance?

As the name suggests, marine insurance applies to ships and boats – and perhaps most importantly the cargo that is carried within them. Also known as ocean insurance, it is one of the oldest types of insurance cover in the world, said to date back to the Babylonian traders of around 2000 BC. Today, it […]

Minimising the impact of an ageing population on the UAE’s healthcare industry

Across the world, the population is ageing. Figures from the United Nations (UN) show that an all-time high 13% of the world’s population is currently aged 60 years or older and their number (962 million) is set to more than double by 2050. Tasked with funding the healthcare of this ageing population, health insurers have already begun to raise their premiums to offset the rising cost. This trend looks set to continue, spelling trouble for employers, who must now make their already stretched budgets go even further to absorb the increasing cost of employee health insurance. But, how can this financial burden be reduced?

Family & work – why providing maternity cover in Kenya makes good business sense

While it’s becoming increasingly common for companies in Kenya to provide private medical insurance for employees, relatively few sign up for the additional option of maternity cover. Yet a glance at the figures – along with emerging trends – suggests that this could be a missed investment opportunity for companies. After all, many women in Kenya combine a career with motherhood, and working mothers are both vital to household incomes and the country’s economy. In this article we take a look at what’s behind this slow take-up of maternity insurance cover and how your organisation could stand to gain by going against the trend.

Takaful insurance: What is it and how could it help your business in Kenya?

Takaful is a form of insurance based on the principles of mutual protection, co-operative risk and profit sharing. Although its origins lie in Islam, it’s available to customers holding any religious belief, not just Muslims. In fact, based on its mutuality principle and other practical features, takaful can be an appealing insurance option for businesses regardless of the religious beliefs of their owners and managers. In this article we explain how takaful insurance came about, what sets it apart from other types of insurance, and how it could benefit your organisation.

Cost cutting? Why reducing employee healthcare isn’t saving you money

If the spiraling cost of employee health insurance is forcing you to consider cutting back on the quality of the healthcare package you offer, think again. Providing your workforce with a cut-price healthcare plan might help to reduce expenditure in the short term but it’s likely to cost you dearly in the long run. Any initial savings are going to be far outweighed by such adverse effects as absenteeism and staff morale, which will hit your bottom line hard and sabotage the business as a whole. Research shows that healthy employees are more cost-effective. According to the World Health Organization (WHO), for every dollar they invest in health, employers get up to six dollars back. Therefore, reducing your healthcare provision will not only hit the wellbeing of your employees but also the wellbeing of your business.

Are wellness programmes a healthy option for Kenyan SMEs?

Corporate wellness programmes are on the rise. Designed to encourage sensible lifestyle choices and help employees tackle existing health issues, many business leaders use them to keep their workforce healthy and medical insurance costs low. According to the Global Wellness Institute, 76% of workers worldwide are struggling with their wellbeing, but just 9% have access to workplace wellness services. And in sub-Saharan Africa, this figure falls to just 1%. So how relevant are wellness services to small and medium-sized businesses in Kenya?

Keep it moving: Why wearable technology could improve your company’s bottom line

A healthy, happy workforce is more productive and less costly to maintain. With more and more UAE companies now coming around to this way of thinking, engaging employees in a workplace wellness programme has become an increasingly popular tactic. In a recent study of employee benefit trends, 93% of UAE employers said that programmes designed to keep employees healthy are important. The rising cost of health insurance, coupled with the growing incidence of chronic conditions such as diabetes, obesity and heart disease, is driving employers to explore new ways of keeping their workforce healthy. One solution that is gaining traction and delivering measurable improvements is the use of wearable technology.

Mandatory health insurance Dubai

With almost 90% of Dubai’s residents from overseas, health insurance has long been a hot topic in the Emirate. While most reputable employers have always provided expat employees with health insurance as part of their benefits package, since 2014 it has been mandatory to do so. The mandatory health insurance Dubai rollout happened in three […]

5 types of insurance Kenyan SMEs can’t afford to ignore

Insurance is a valuable tool that businesses can use to protect themselves from the multitude of risks they face on a daily basis. Small and medium enterprises (SMEs) in Kenya have generally been slow to invest in anything more than the statutory minimum insurance. However, this could be leaving them dangerously exposed. So let’s take a look at five key categories of insurance cover that could protect your SME.

The big conversation – why Middle East businesses need to talk about Breast Cancer Awareness Month

Breast cancer is one of the biggest killers of women in the Middle East. That’s according to the World Health Organization (WHO) and while it can be a difficult subject to broach, ignoring it leads to fatal consequences. Breast cancer doesn’t only affect the person who is diagnosed with it, but also their family, co-workers, business, and the country in which they live. What’s more, when this disease is not dealt with early on, the chances of survival fall significantly. So raising awareness of the issue and ensuring that your staff members have proper access to screening facilities is essential. Doing so will help ensure you are putting the well-being of your staff at the top of your priorities.

Health & tech: Why the latest innovations reduce healthcare costs for your Middle East business

The demand for quality healthcare in the GCC countries has never been higher, with the range of services and advancements constantly evolving. With the growing global digitisation of the healthcare industry, insurance providers are looking not only to provide the latest products and services in line with the changing needs of their client base, but also to maintain the highest standards without pricing themselves out of the market. So in this age of smart health, what are the key trends and innovations you should know about when making those key decisions about benefit provision for your workforce?

What is professional indemnity insurance?

Professional indemnity insurance protects you against claims of professional negligence made by dissatisfied customers. These could be complaints that you have offered poor advice, or made a mistake in your service which impacts your client. Professional indemnity insurance can also protect against claims for loss of documents or client data, defamation or libel, and unintentional […]

We need to talk – why Breast Cancer Awareness month is important to your staff in Kenya

Breast cancer is on the rise in Kenya. And that has an impact on women, their families, their co-workers, businesses, and the country as a whole. Worryingly, women here are succumbing to it at a much younger age compared to much of the world, and cases are often not picked up until they have reached an advanced stage – so mortality rates are high. Early diagnosis is key to effective treatment and survival, and this is where you, as employers, can make a difference. Increasing your employees’ awareness of breast cancer and helping them to access screening services will improve the health of your staff and demonstrate your commitment to their wellbeing, while helping to keep your health costs down. October is Breast Cancer Awareness Month, so what better time to tackle this challenging issue in your workplace.

Why fraud is a major threat to your SME’s health costs (and how to beat it!)

Here in Kenya, insurance fraud is never far from the headlines. Medical insurance fraud is, in particular, attracting increasing attention. Some industry experts are pointing to it as a key cause of escalating losses in the medical insurance sector. And while it’s hard to quantify the full extent of the problem, it’s clear that it’s having a negative impact on the industry. It also has an inevitable effect on the price of premiums, which can be a worry for cost-sensitive small and medium-sized (SME) businesses. So let’s take a look at the extent of the problem and see what SMEs can do to help tackle it.

Truth or exaggeration – does social media affect your employees’ health and productivity?

In HR or management roles there is a point to every action taken. The objective of the human resource professional is to ensure a workforce is able to perform to the best of its collective ability. So where does social media usage at work fit into all this? Today, it’s certainly common to include brief references to social media usage in employee handbooks – usually connected with portrayal of the company – but less about individual usage and its impact on productivity, engagement and performance. Making that jump is not easy, so the first step is to look at how social media affects overall health, then from there try to understand any impact it has on productivity.

5 big trends that could slash health costs for Kenyan SMEs

In recent years, private health insurance premiums in Kenya have been rising at double the rate of inflation, possibly deterring small and medium-sized companies (SMEs) from protecting the health of their workforce. This has huge implications, not just for the employees themselves, but for the productivity of companies impacted by staff sickness. Currently, only around 4% of the Kenyan population is covered by private health insurance, and the majority of those are formal sector workers. But with the rising costs, how can SMEs keep their expenses low? In this article we look at five big trends that could slash health costs for Kenyan SMEs.

Flawed finances: Can employee debt sabotage your bottom line?

How much do you know about your employees’ finances? You know what you pay them, of course, but do you have any idea how they manage their money – or, more importantly, if they are managing? Many employers hold the belief that their employees’ personal finances are none of their business, but what if an employee has money worries that begin to affect their work? Does it then become your business?

Why put your staff and company at risk? Emergency evacuation cover in Africa is a must

If you have staff based across Africa, it’s worth giving serious consideration to providing emergency evacuation cover, enabling them to get to safety in case of illness, injury or major threats. Africa is a huge and diverse continent and the level of medical provision available across – and even within – its 54 countries is equally varied. The levels of danger to health and personal wellbeing also vary widely. In this article we look at why emergency evacuation cover is needed and how to make sure your employees receive it.

How to reduce your company’s healthcare costs without compromising on quality

When it comes to the most valued staff benefit an employer can offer, health insurance is right there at the top of the list. Being able to provide a comprehensive healthcare package really can help seal the deal when it comes to attracting and retaining the best talent. But regardless of the size of your business, offering such a premium package can come at a steep price. Over the past decade global growth in healthcare spend has risen between 6.8 and 11.9% per year – consistently several points above general inflation, and this trend is set to continue. So, let’s look in practical terms at how to help bring down your healthcare spend without compromising on quality of care.

How healthier and happier employees save your company money

How productive are your employees? It’s a surprisingly tricky question. In truth, most HR professionals and even business owners have no idea how much work their staff members are actually doing on a day-to-day basis. It’s just not something they actively monitor. Many bosses simply assume that all is running smoothly within their ranks. But the real numbers are surprising. While many employees spend at least seven hours per day in the workplace, excluding breaks, much of that time goes to waste. So what’s causing this general low level of efficiency and productivity in the workplace?

The role of the employer in curbing the rising costs of healthcare in Africa

If you provide private medical insurance for your staff, you will have almost certainly noticed a rise in premiums over recent years. There are several factors that influence increasing medical insurance premiums. Some of them are global phenomena while others are more specific to Kenya. No matter the cause, there are many ways that you as an employer can help keep the cost of providing quality healthcare for your staff in check. So let’s take a look at why costs are rising so much – and what you can do about it.

How customising staff health insurance benefits SMEs

While the concept of providing different levels of health insurance benefits for different levels of staff isn’t new, it hasn’t really been common practice among small and medium-sized companies until recently. But now the arguments for tailoring health insurance benefits are stronger than ever – regardless of the size of your organisation. Last year’s arrival of mandatory health insurance for all employees in Dubai probably affected SMEs most, making a serious dent in what are already limited budgets. You may have been tempted to keep costs down by going for basic local coverage, leaving your employees to top up their cover independently if they require a higher level. But in doing so, you could be missing a trick.

Key changes in Kenyan insurance regulations and how they affect business owners

Since 2013, Kenya’s insurance industry has undergone a welcome overhaul. The government has introduced a series of much-needed changes designed to clamp down on unethical and irresponsible business practices and to protect those who buy insurance. While the new, tighter regulations may initially seem complex, they will ensure that the cover you pay for will provide your employees with the high-quality protection they need. Whether you’re considering providing health insurance, or it’s been part of your company benefits package for some time, here’s what you must know about the new regulations.

Six Insurance Renewal Considerations For SMEs

It’s medical insurance renewal time. That letter lands on your desk. How do you respond? Employee medical insurance, now a mandatory requirement in parts of the UAE and likely to become one throughout the region in years to come, is a major financial consideration for any business. HR professionals and SME owners who treat insurance renewal as an important time in their annual business planning can score a major advantage over those who don’t, in terms of saving money, improving the service they receive and, by extension, improving employee satisfaction and recruitment appeal. So how should you approach renewal time, what questions should you ask and what are the indicators that you’re getting good value for your business?

Private medical insurance for older people in East and Central Africa

Thanks to improvements in healthcare, we can all expect to live longer. This in turn increases demands on healthcare services. Living a long life could mean a lot of medical bills. The more complex your medical needs, the higher the bill could stack up. So how can you keep these costs down as a senior citizen? In this article we look at the major issues to keep in mind when you’re shopping around for senior health insurance, either for yourself or an elderly relative.

What should SMEs consider when choosing their employee health insurance policy?

Small and medium sized enterprises (SMEs) play a huge role in the UAE economy, accounting for an estimated 95% of GDP and 90% of the workforce. Translate that across the Gulf region and it makes for a lot of SME owners and directors agonising over which health insurance policy to choose for their workers. Trying to maximise quality care and benefits, at a cost the business can afford, is a minefield even for professionals. It’s tempting to go for the cheapest option, but that isn’t always the best long-term strategy. In this article we look at an overview of factors to take into account if you’re in the process of choosing or changing your provider.

Operating across Africa? Why consolidating employee health insurance is a must

If your company has several bases across Africa and you’ve opted for a decentralised approach to employees’ health insurance, you’re almost certainly missing out on great savings – not to mention attractive, tailor-made packages and a slick, efficient admin process. Whether you have regional offices, subsidiaries or even project sites, co-ordinating your health insurance through a single broker or advisory company makes great business sense. In this article we explore why.

Should I stick with one health insurance broker or change regularly?

Picking the right insurance plan as a business can be quite daunting. There is a lot to think about, a lot to do, and a lot to compare – especially when it comes to the intricacies of mandatory health insurance in the Middle East. You could make your life easier by entrusting a broker to take care of all the questions and find the best cover for you. The very best brokers will know the healthcare market and learn your business inside-out. They save you a lot of money, hassle and more. But finding a broker you trust is something a lot of businesses struggle with, especially small and medium sized enterprises (SMEs). In this article we look at what you should be doing to get the best cover for your company.

Filling the gaps in Kenya’s state funded medical insurance

When your business operates in a country such as Kenya which provides state-subsidised health insurance, is there any need to take out private cover for your employees? It’s a common dilemma but it’s important to be aware of the relative benefits that state-funded and private health cover offer, so that you can make the most informed choice possible. A 2011 report by Deloitte found that, of the roughly eight million Kenyans who currently have some kind of health insurance, 85% are covered under the National Hospital Insurance Fund (NIHF). But it is not a comprehensive service, so employers wanting to safeguard the wellbeing of their staff would be well advised to consider private medical insurance (PMI). In this article we weigh up both sides to help you decide what’s best for your company and your employees.

Why Kenya is fast becoming an African centre of medical excellence

Medical care in Kenya has made great strides in recent years. Between 1995 and 2014, government health spending doubled from 6.4% to 12.8%, according to the World Bank. This has brought great benefits for overall health and longevity, with life expectancy now at 63 compared with 52 in 2000. The past decade has also seen a steady rise in funding from international donors and NGOs, as well as investment from private organisations, further helping to strengthen the country’s health infrastructure. With that in mind, let’s take an in-depth look at the developments that have taken place in Kenya’s health sector over the past few years – and see how to provide better health outcomes for your employees based in the region.

Global insurtech trends that are reshaping the industry

Fintech is big business, estimated to be worth nearly USD 25bn globally in 2016. And just as technology has impacted finance, it now looks set to have similar influence on the insurance market. A few years from now, our sector will look quite different. More and more new businesses are positioning themselves as challengers, with USD 1.7bn of investment going into insurtech startups last year alone. This is happening on a global level – with firms such as Friendsurance in Germany, PeerCover in New Zealand, and Oscar healthcare in the US, all changing the game. With that in mind, let’s now look at the some of the trends that are starting to change the insurance industry.

Top-up health insurance plans for C-suite company executives

Health insurance is not only an essential element of an employee benefits package, but a key component in attracting and retaining high-calibre talent. In Dubai, it’s mandatory for employers to provide it, while in Abu Dhabi they must also add cover for dependants. However, the standard of coverage is sometimes lower than most senior executives would expect, particularly those at C-suite level – that is, CEOs, CFOs, COOs, and similar. With this in mind, permanent international private medical insurance plans (IPMIs) are well placed to provide a better way for C-suite executives to take care of themselves and their families in the UAE. They function essentially by ‘topping up’ an executive’s existing local plan, so they work in sync with each other. In this article we look at how these top up plans can help C-suite employees receive the cover they require.

Insurance company or insurance broker – Why choose a broker in the UAE?

Insurance is essential to protect your business and its assets, from your premises and equipment to the health of your staff. But what’s the best way to decide which insurance products to buy and what levels of coverage you need? With online tools and other such resources it’s certainly becoming easier to get an overview of some of the options available, but that doesn’t mean the decision is any easier to make. Whether to work with an insurance broker or not is often debated, but interaction with professional brokers is perhaps needed now more than ever to help you understand the complexities of it all. In this article we look at why using an insurance broker may be the best step forward for your UAE company.

Cheapest health insurance in Dubai

Since the roll out of mandatory health insurance in Dubai, many employers are engaging in a race to the bottom to find the cheapest health insurance on the market. While there are certainly options available, the cheapest health insurance in Dubai may not be the right fit for your business or your employees. Basic packages […]

Is local or international health insurance better for your staff?

Whether to provide local or international health insurance for staff is a common dilemma. On the one hand, you want to provide health coverage that will put your employees’ minds at rest and make them feel valued; on the other hand, the choice needs to make financial sense for your company. This is a difficult issue especially in Dubai, where all employers have been responsible for providing health coverage for their entire workforce since June 2016. We look at the advantages of both international and local health coverage to help you decide which one is a better fit for your company.

Pension plans in the UAE: Progress but some way to go

Pensions are a good thing. We all need to plan for the time when we will no longer have an income from work, and ensure we have enough funds to live on in old age. But we are now living longer, so our retirement savings need to stretch further. This is one of many factors that make pensions a complicated area, even for business-savvy professionals, and one that needs careful planning and expert advice.

Will cyber security threats bring down your company?

For the third year in a row, the agenda of the January 2017 meeting of the World Economic Forum (WEF) at Davos was dominated by the cyber crime threat and by the need for businesses to improve their resilience in preventing and combating it. And with good reason: Cyber crime is big business and can compromise or bring down any company in any country. In this article we take a closer look at what companies can do to limit their exposure to such risks.

What extent does the health insurance you offer affect talent attraction and retention?

According to the Hays GCC Salary and Employment Report 2015, 69% of respondents said they were not satisfied with their current salary and benefits package, and 57% said they were anticipating a move to a new company in 2016. After salary, the main reason they gave for desiring a move was to secure a better benefits package. It’s time for employers here to get serious about what’s on offer for their current staff and those they’re looking to hire.

Why SMEs should consider flexible benefits for staff

With insurance premiums increasing across the globe, particularly for health cover, companies of all sizes are keen to find ways to make savings – crucially, without alienating their workforce and while still remaining attractive to potential new recruits. Since the early 2000s, employers have been looking to flexible benefits to help them achieve this. Known […]

Health insurance cost drivers and your company’s people strategy

Are you concerned about further rises in the cost of health insurance for your employees this year? Quite rightly, you don’t want to remove this benefit as it serves as a major incentive for both your current and prospective staff, but you know you can’t keep paying higher and higher premiums. Unfortunately the upward trend […]

How your company can get health insurance overuse under control

What is behind the overuse of company health insurance? How is it affecting your annual premium? And what can you do to control it? This is a pressing issue. With employers in Abu Dhabi, Dubai and Saudi Arabia now responsible for providing health insurance for their staff and with compulsory coverage being rolled out in […]

Financial Advice From Lifecare International – Reviewing Your Financial Investments

While reviewing how well your investments have done, what is the first question you should ask your financial advisor? Not what % have they gone up? But rather how much risk did my investments have? In order to make a return on my capital? The key to understanding how well your investments are managed is in asking the […]

Fasting Healthily During Ramadan

Here is a good article on healthy fasting as we get into Ramadan season: Credit source: http://www.rmit.edu.au/students/health/ramadan The month of Ramadan is a great opportunity to focus on bringing back a balanced and healthy lifestyle. Through fasting you learn how to manage your eating habits and improve self-discipline. The following information aims to help you […]

![Motor Fleet Insurance in Dubai, UAE [2023 Ultimate Guide]](https://lifecareinternational.com/wp-content/uploads/2023/05/158938871_m_normal_none-1024x721.jpg)

![Directors And Officers Insurance Dubai [2023 Guide]](https://lifecareinternational.com/wp-content/uploads/2022/12/176147320_m-1024x683.jpg)